Ship’s Condition Inspection Backed Valuation Surveys & Certification

Ship and vessel valuation surveys are considered an important aspect during a vessels life cycle, and are tricky and arduous engagements to accomplish, often requiring a combination of skills including seafaring, financial and statistical capabilities, irrespective of the size and type of the vessel, or the purpose for which the valuation is carried out.

Having completed, to date, over 150 valuation assignments,

Constellation Marine Services are extremely well placed

to offer unparalleled services in this regard, and we remain

unbiased, independent, and objective in our findings and

results.

While we understand the underlying objective of a valuation

survey is to arrive at an assets Fair Market Value, we also

believe there is more than one approach in arriving at this,

and therefore we utilize an accepted and systematic approach

combined with a standard mechanism to determine the value

of the ship or vessel.

This is particularly true when the factors affecting

a ships value are considered, including but not limited

to Market conditions, sentiments, supply and demand statistics,

age and remaining economic useful life of the vessel being

valued, design specifications, and last but not the least,

the vessels maintenance, upkeep and performance.

For sale and purchase, and those that include willing buyers

and sellers, this model adds considerable support to their

decision making, and generally removes ambiguities and assumptions

that would otherwise arise due to the asset not physically

inspected, including assurances that the value will remain

same post a specific date of the valuation.

Contrary to popular belief, ships can be valued at any

stage of their life cycle, including New Buildings, for

ships in operation, for ships in pre contract stage, during

refurbishment and upgrading or during their end of life

cycle such as demolition.

The valuation process involves numerous stages, and generally

starts with receipt of client’s information, and may often

lead to either a desktop valuation, or proceed to a physical

condition survey including an onboard assessment of the

condition of the vessel.

The process will then progress to a Market study and

data collection of a price idea, analysis and calculation

of the vessels useful remaining economic life, to arrive

at a fair market estimation, further to which an analysis

of replacement cost and sale comparison is made to determine

the vessels value reconciliation.

A physical evaluation of the condition itself has numerous

stages, including the vessels overall examination of its

hull structure, fittings, machinery, class and statutory

status etc, with a perspective to gauge their availability,

functionality and maintenance condition, and thereafter

summarize and finalize the physical condition survey findings

for the benefit of the valuator.

An evaluation thereafter is made for Market indicators

such as Spending / Capex availability, asset utilization,

freight, and charter rates to determine operability, statistics

on situation for new orders and scraping (supply and demand)

etc.

An assessment thereafter is made with regards to the vessels

effective age and economic useful life, where factors such

as comparison with an asset of like kind, the duration of

profitable use, the assets overhaul and rebuild status.

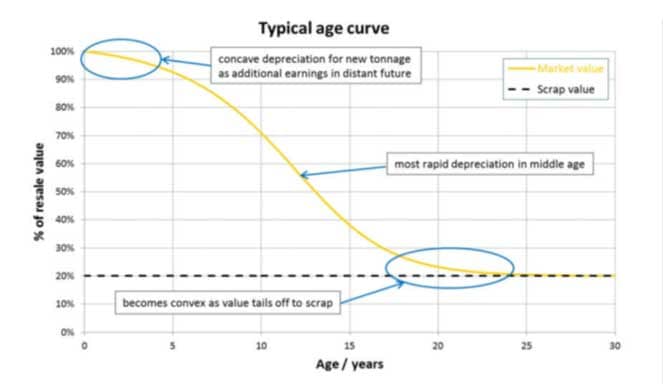

Comparisons to typical vessel age curves is thereafter evaluated, and historically compared with those populated by industry leaders, such as the one from EXIM bank extracted for the year 2019, appended below, as an example:

In certain cases, and as for specific purpose vessels, a Sales Comparison approach may also be considered, where simply put, the value of the asset may be determined by analyzing recent 2nd hand sales (offered sales prices) that are similar in nature and type to the asset being valued. This methodology provides a value overview for “specialized crafts” such as high-speed passenger ferries, dynamic positioned offshore assets, diving support vessels, specialized chemical, and gas carrier vessels.

The process thereafter arrives and culminates to the value reconciliation stage, where comparisons and gaps (if any) between the various approaches are made reliable by either seeking more data on the vessel or the adopted approach, or if the gap is narrow, considered less uncertain to state a Fair Market value. A standard market accepted Statement or certificate of Valuation is thereafter issued, with stated emphasis on the valuation date.

The process thereafter arrives and culminates to the

value reconciliation stage, where comparisons and gaps (if

any) between the various approaches are made reliable by

either seeking more data on the vessel or the adopted approach,

or if the gap is narrow, considered less uncertain to state

a Fair Market value.

A standard market accepted Statement or certificate of Valuation

is thereafter issued, with stated emphasis on the valuation

date.

Constellation Marine services can be contacted at any time for your valuation needs and we would be more than happy to provide a service that we are certain will meet and exceed your expectations by our team of Chief Engineers, Master Mariners, and Naval Architects.

Constellation Marine services can provide an unbiased valuation service, may it be for sale & purchase, security or mortgage, court sales and legal disputes or for Insurance and risk underwriting, through in house proprietary resources that include Chartered engineers & Valuators, Naval architects, Marine Chief engineers and Master Mariners.